indiana estate tax return

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Cashing a Refund Check If you the surviving spouse administrator or executor received a refund and cant cash the check youll need to contact the Auditor of States office for assistance in.

Estate Tax Information Noevalleylaw

Individuals IT-40 Indiana Individual Income Tax Return.

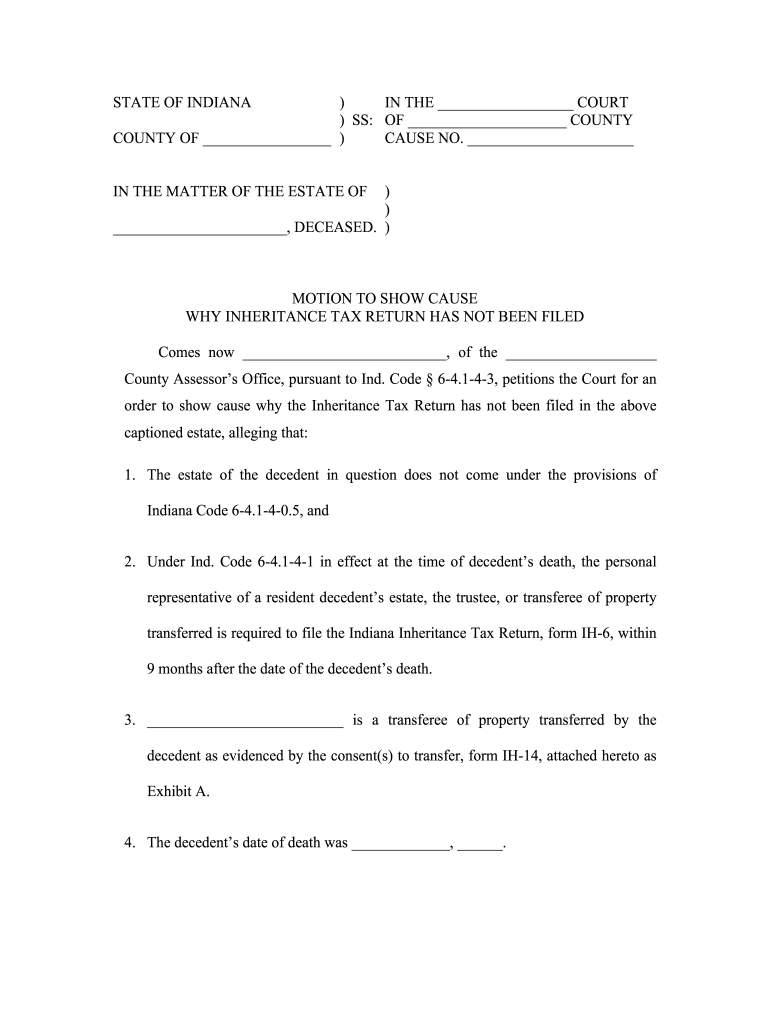

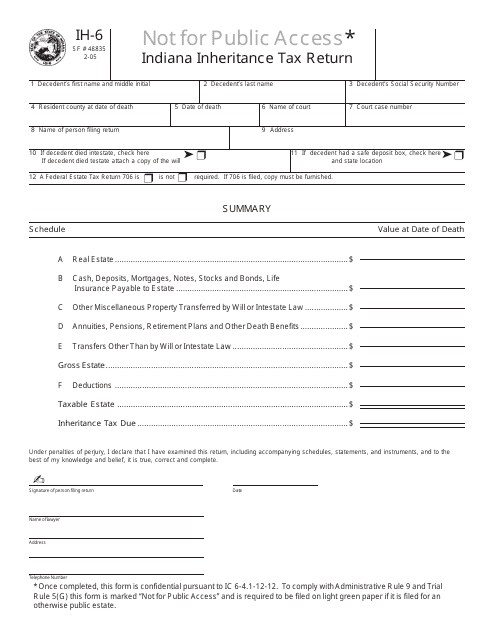

. Of the estate or trust. Up to 25 cash back Filing the Inheritance Tax Return Inheritance tax returns Form IH-6 Affidavit of No Inheritance Tax Due Form IH-Exem instructions and current tax rates are. Indiana Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers state-specific forms and templates in Word and PDF format that you can instantly download fill out.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. 55891 Beneficiarys Share of Indiana Adjusted Gross. The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO.

Indiana estate tax return Wednesday August 31 2022 Edit. If there is tax due report the tax. The types of taxes a deceased taxpayers estate.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. No tax has to be paid. If you are filing a calendar-year return please enter the 4-digit tax year in the box YYYY.

31 rows Filing Estate and Gift Tax Returns When to File Generally the estate tax return is due nine months after the date of death. This tax return is used by the fiduciary representative to report the income deductions gains losses etc. 50217 Fiduciary Payment Voucher 0821.

The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. If you are filing a. Indiana Current Year Tax Forms Forms downloaded and printed from this page may be used to file taxes unless otherwise specified.

Indiana Fiduciary Income Tax Return 0821 fill-in pdf IT-41ES. Estate Tax Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. 1099 1040 from the IRS.

The income that is either. Please read carefully the general instructions before preparing. Do not file Form IH-6 with an Indiana court having probate.

In addition no Consents to Transfer Form IH-14. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department. Therefore no inheritance tax returns must be filed at this time.

Individual trust guardian or estate. Income Tax Return for Estates and Trusts. Fill-in pdf IT-41 Schedule IN K-1.

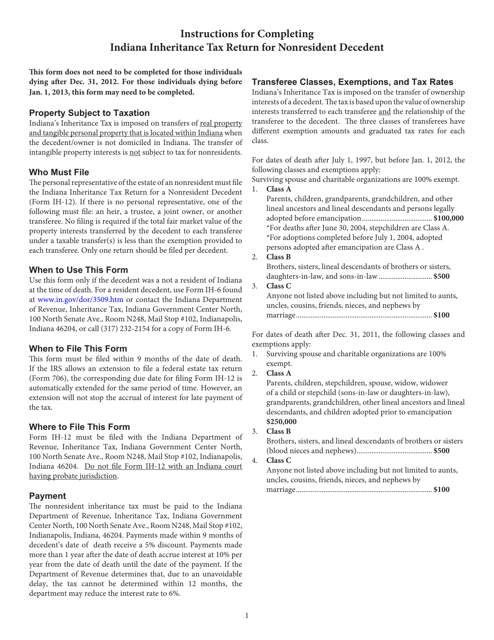

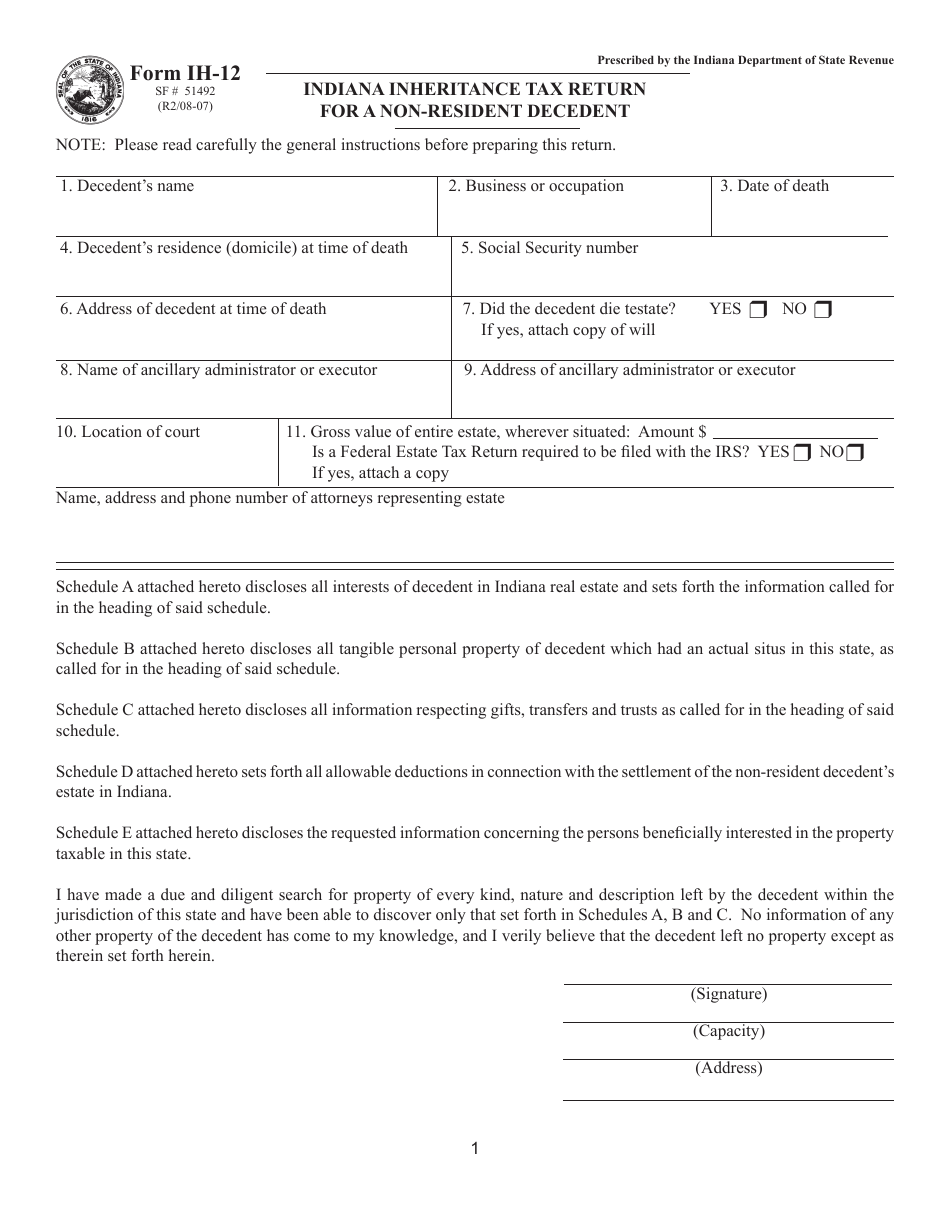

The fiduciary return will report only the amount of tax computed on the individual income tax return. A six month extension is available if requested prior to the. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note.

Box 71 Indianapolis IN 46206-0071. Find federal tax forms eg. Taxpayer as shown on Form 1041 US.

In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption. If you file a.

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Fillable Online Motion To Show Cause Fillable Form Indiana Fax Email Print Pdffiller

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How Indiana Probate Law Works Probate Advance

Here S The Average Tax Refund People Get In Every Us State

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

State Estate And Inheritance Taxes Itep

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Download Instructions For Form Ih 12 State Form 51492 Indiana Inheritance Tax Return For A Non Resident Decedent Pdf Templateroller

Estate Inheritance Tax Threshold Rates Calculating How Much You Owe

More Than Half Of America S 100 Richest People Exploit Special Trusts To Avoid Estate Taxes Propublica

How Could We Reform The Estate Tax Tax Policy Center

Free Indiana Small Estate Affidavit Form 49284 Pdf Eforms

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Indiana Sees Big Budget Surplus Jump As Tax Refund Eyed Wowo 1190 Am 107 5 Fm

Indiana Retirement Tax Friendliness Smartasset

State Form 51492 Ih 12 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return For A Non Resident Decedent Indiana Templateroller